Margin Calculators for Options

The margin requirements for option strategies for both Reg T and Portfolio Margin accounts can be complex. For Reg T, the margin is determined using a set of predefined rules. These rules consider different characteristics of the strategy such as: time to expire of the options, whether the option is in or out of the money, whether the option has another option or underlying position hedging the option, type of underlying (stock, index, ETF), and other characteristics. Under Portfolio Margin, the margin requirements are set based on the methodology discussed in other areas of the website.

The bottom line is that with both types of accounts it's not always simple to determine the margin. Therefore, it is useful to verify the margin requirement using a margin calculator. Below we present two different calculators for the two different types of accounts.

The bottom line is that with both types of accounts it's not always simple to determine the margin. Therefore, it is useful to verify the margin requirement using a margin calculator. Below we present two different calculators for the two different types of accounts.

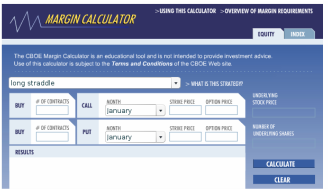

Reg T Margin Account

Made available by the Chicago Board Options Exchange, this calculator allows you to select from over 30 different option strategies. It calculates the exact margin requirements for a Reg T margin account. Click on the picture below to open the calculator.

Made available by the Chicago Board Options Exchange, this calculator allows you to select from over 30 different option strategies. It calculates the exact margin requirements for a Reg T margin account. Click on the picture below to open the calculator.

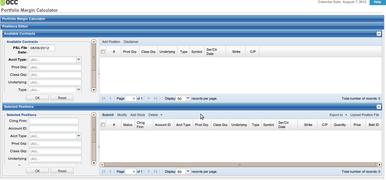

Portfolio Margin Account

Made available by the Options Clearing Corporation, this calculator allows you to select a portfolio of stock and options positions. It then outputs the exact margin requirements for a Portfolio Margin Account. Click the picture below to open the calculator.

Made available by the Options Clearing Corporation, this calculator allows you to select a portfolio of stock and options positions. It then outputs the exact margin requirements for a Portfolio Margin Account. Click the picture below to open the calculator.