| It's not all bad news though - the current climate is also punctuated by healthy dividend payouts on a wide range of equity securities. In this post we'll explore a portfolio that has the same level of risk as the S&P 500, but with dividend yield of 14%. This strategy is made possible by the low level of margin loan rates currently available to investors. For example, a 200k account at Interactive Brokers has a loan rate of roughly 1.4%. | "Simply put, bond yields are far too low to warrant meaningful attention from income driven investors." |

Typically, a portfolio with such large dividend yield comes with substantial risk. In order to mitigate this risk we'll use both long and short positions. This allows us to hedge out a significant portfion of this risk.

- Leverage: No more than 5:1 leverage will be allowed. Note that this level of leverage can only be achieved with a Portfolio Margin account. If you don't have a PM account, see our list of Portfolio Margin brokers to find a suitable broker.

- Min/Max Individual Stock Weighting: no more than 3.5% of the portfolio can be invested in any single stock (anything greater would result in far too much asset-specific risk).

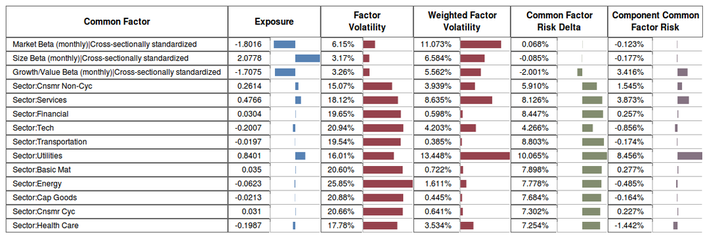

- Portfolio Construction Method: Mean variance optimization is used to ensure the portfolio minimizes risk while maximizing dividend yield. The risk model used in this optimization attributes risk to style and sector factors. This is similar to models available from commercial vendors such as Barra, Northfield and Axioma.

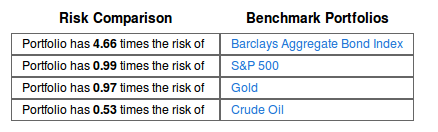

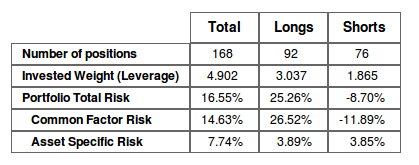

Risk is also attributed to "Common Factor" risk and "Asset Specific" risk. Common Factors drive returns across multiple assets and thus are the source of correlation between securities (think sector/industry risk and the so called "style" factor risk such as value/growth and size). In contrast, asset specific risk emanates from a the operations of an individual company and is diversifiable within limits (i.e. asset specific risk decreases as we add positions to the portfolio). As we can see, Common Factor risk dominates the portfolio at 14.63%, while Asset Specific Risk is 7.74%. To get to the Portfolio Total Risk, we add the square of the Common Factor Risk to the square of the Asset Specific Risk and then take the square root of this number.

Most of the columns in the table are self explanatory, however, the "Component Total Risk" deserves further commentary. The Component Total Risk represents the risk emanating from that specific position considering the portfolio context. A positive value means the position adds to risk. A negative value means the position decreases (i.e. hedges out) risk. The sum of these values is equal to the "Portfolio Total Risk" show in Figure 2.

Portfolio Composition - Long/Short with 14.3% Dividend Yield

| Ticker | Trade Type | Trade Quantity (# of Shares) | Weight | Component Total Risk | UnWeighted Div Yield | Weighted Div Yield |

|---|---|---|---|---|---|---|

| &CASH | --171677 | -17.17% | 0.00% | 0.00% | 0.00% | |

| ABT | BUY | 543 | 3.50% | 0.25% | 3.17% | 0.11% |

| ADBE | SELL | 1048 | -3.50% | -0.10% | 0.00% | 0.00% |

| ADSK | SELL | 1101 | -3.50% | -0.03% | 0.00% | 0.00% |

| AEE | BUY | 1226 | 3.50% | 0.36% | 5.57% | 0.20% |

| AEP | BUY | 853 | 3.50% | 0.38% | 4.59% | 0.16% |

| AIG | SELL | 237 | -0.78% | -0.05% | 0.00% | 0.00% |

| AIV | BUY | 217 | 0.54% | 0.04% | 3.10% | 0.02% |

| AKAM | SELL | 524 | -1.88% | -0.05% | 0.00% | 0.00% |

| ALXN | SELL | 370 | -3.50% | -0.13% | 0.00% | 0.00% |

| AMD | SELL | 6219 | -1.21% | 0.05% | 0.00% | 0.00% |

| AMZN | SELL | 47 | -1.13% | -0.07% | 0.00% | 0.00% |

| AN | SELL | 832 | -3.50% | -0.25% | 0.00% | 0.00% |

| APOL | SELL | 73 | -0.14% | -0.01% | 0.00% | 0.00% |

| AVP | BUY | 2454 | 3.50% | 0.21% | 5.37% | 0.19% |

| BBBY | SELL | 582 | -3.50% | -0.11% | 0.00% | 0.00% |

| BBY | BUY | 2991 | 3.50% | 0.35% | 5.62% | 0.20% |

| BIG | SELL | 775 | -2.21% | -0.12% | 0.00% | 0.00% |

| BIIB | SELL | 234 | -3.51% | -0.20% | 0.00% | 0.00% |

| BMY | BUY | 1073 | 3.50% | 0.30% | 4.20% | 0.15% |

| BRK-B | SELL | 395 | -3.50% | -0.28% | 0.00% | 0.00% |

| BSX | SELL | 6261 | -3.50% | -0.17% | 0.00% | 0.00% |

| BWA | SELL | 76 | -0.50% | -0.02% | 0.00% | 0.00% |

| C | SELL | 971 | -3.50% | -0.26% | 0.11% | 0.00% |

| CA | BUY | 1584 | 3.50% | 0.07% | 4.57% | 0.16% |

| CAM | SELL | 643 | -3.50% | -0.18% | 0.00% | 0.00% |

| CBG | SELL | 1959 | -3.50% | -0.20% | 0.00% | 0.00% |

| CCI | SELL | 518 | -3.50% | -0.25% | 0.00% | 0.00% |

| CELG | SELL | 164 | -1.29% | -0.07% | 0.00% | 0.00% |

| CERN | SELL | 121 | -0.95% | -0.02% | 0.00% | 0.00% |

| CFN | SELL | 1248 | -3.50% | -0.19% | 0.00% | 0.00% |

| CINF | BUY | 868 | 3.50% | 0.29% | 4.05% | 0.14% |

| CLF | BUY | 1121 | 3.50% | 0.36% | 6.96% | 0.24% |

| CME | BUY | 641 | 3.50% | 0.23% | 4.08% | 0.14% |

| CMG | SELL | 98 | -2.69% | -0.06% | 0.00% | 0.00% |

| CMS | BUY | 1488 | 3.50% | 0.35% | 4.08% | 0.14% |

| CNP | BUY | 1817 | 3.50% | 0.36% | 4.21% | 0.15% |

| COP | BUY | 618 | 3.50% | 0.29% | 4.66% | 0.16% |

| CRM | SELL | 61 | -0.97% | 0.01% | 0.00% | 0.00% |

| CTL | BUY | 909 | 3.50% | 0.27% | 7.67% | 0.27% |

| CTSH | SELL | 395 | -2.63% | -0.07% | 0.00% | 0.00% |

| CTXS | SELL | 259 | -1.60% | -0.01% | 0.00% | 0.00% |

| CVC | BUY | 2504 | 3.50% | 0.44% | 4.27% | 0.15% |

| CVX | BUY | 332 | 3.50% | 0.30% | 3.37% | 0.12% |

| D | BUY | 698 | 3.50% | 0.35% | 4.14% | 0.14% |

| DD | BUY | 812 | 3.50% | 0.24% | 4.01% | 0.14% |

| DF | SELL | 285 | -0.48% | -0.02% | 0.00% | 0.00% |

| DLTR | SELL | 833 | -3.50% | -0.14% | 0.00% | 0.00% |

| DNR | SELL | 2224 | -3.50% | -0.19% | 0.00% | 0.00% |

| DO | BUY | 520 | 3.50% | 0.26% | 5.25% | 0.18% |

| DOW | BUY | 1191 | 3.50% | 0.28% | 3.96% | 0.14% |

| DPS | BUY | 781 | 3.50% | 0.21% | 3.04% | 0.11% |

| DRI | BUY | 654 | 3.50% | 0.25% | 3.54% | 0.12% |

| DTE | BUY | 594 | 3.50% | 0.36% | 4.04% | 0.14% |

| DUK | BUY | 579 | 3.50% | 0.36% | 5.01% | 0.18% |

| DVA | SELL | 281 | -3.13% | -0.23% | 0.00% | 0.00% |

| ED | BUY | 647 | 3.50% | 0.35% | 4.46% | 0.16% |

| EL | SELL | 587 | -3.50% | -0.14% | 0.00% | 0.00% |

| EMC | SELL | 1411 | -3.50% | -0.02% | 0.00% | 0.00% |

| ETFC | SELL | 4300 | -3.50% | -0.18% | 0.00% | 0.00% |

| ETR | BUY | 564 | 3.50% | 0.38% | 5.33% | 0.19% |

| EXC | BUY | 1225 | 3.50% | 0.36% | 7.28% | 0.25% |

| FE | BUY | 852 | 3.50% | 0.34% | 5.34% | 0.19% |

| FFIV | SELL | 323 | -2.98% | 0.03% | 0.00% | 0.00% |

| FISV | SELL | 464 | -3.50% | -0.13% | 0.00% | 0.00% |

| FMC | SELL | 639 | -3.50% | -0.22% | 0.64% | -0.02% |

| FRX | SELL | 1050 | -3.50% | -0.21% | 0.00% | 0.00% |

| FSLR | SELL | 289 | -0.71% | -0.04% | 0.00% | 0.00% |

| FTI | SELL | 838 | -3.50% | -0.21% | 0.00% | 0.00% |

| FTR | BUY | 7795 | 3.50% | 0.43% | 8.91% | 0.31% |

| GAS | BUY | 932 | 3.50% | 0.36% | 4.88% | 0.17% |

| GCI | BUY | 1963 | 3.50% | 0.36% | 3.87% | 0.14% |

| GILD | SELL | 270 | -2.06% | -0.12% | 0.00% | 0.00% |

| GIS | BUY | 2 | 0.01% | 0.00% | 3.14% | 0.00% |

| GNW | SELL | 5641 | -3.19% | -0.20% | 0.00% | 0.00% |

| GOOG | SELL | 4 | -0.27% | -0.01% | 0.00% | 0.00% |

| GT | SELL | 2188 | -2.59% | -0.18% | 0.00% | 0.00% |

| HAS | BUY | 561 | 2.15% | 0.12% | 3.66% | 0.08% |

| HCBK | BUY | 4289 | 3.50% | 0.38% | 3.99% | 0.14% |

| HCN | BUY | 581 | 3.50% | 0.31% | 4.94% | 0.17% |

| HCP | BUY | 766 | 3.50% | 0.31% | 4.41% | 0.15% |

| HNZ | BUY | 599 | 3.50% | 0.22% | 3.45% | 0.12% |

| HPQ | BUY | 2814 | 3.50% | 0.13% | 4.22% | 0.15% |

| HRB | BUY | 1920 | 3.50% | 0.33% | 4.45% | 0.16% |

| HSP | SELL | 815 | -2.40% | -0.13% | 0.00% | 0.00% |

| INTC | BUY | 1775 | 3.50% | 0.13% | 4.49% | 0.16% |

| ISRG | SELL | 12 | -0.65% | -0.04% | 0.00% | 0.00% |

| JDSU | SELL | 2025 | -2.36% | 0.00% | 0.00% | 0.00% |

| JNJ | BUY | 503 | 3.50% | 0.28% | 3.48% | 0.12% |

| K | BUY | 633 | 3.50% | 0.21% | 3.14% | 0.11% |

| KIM | BUY | 1826 | 3.50% | 0.27% | 4.00% | 0.14% |

| KLAC | BUY | 775 | 3.50% | 0.15% | 3.40% | 0.12% |

| KMX | SELL | 32 | -0.11% | -0.01% | 0.00% | 0.00% |

| LEG | BUY | 1276 | 3.50% | 0.31% | 4.19% | 0.15% |

| LH | SELL | 105 | -0.88% | -0.06% | 0.00% | 0.00% |

| LIFE | SELL | 699 | -3.50% | -0.21% | 0.00% | 0.00% |

| LLTC | BUY | 362 | 1.18% | 0.04% | 3.13% | 0.04% |

| LLY | BUY | 733 | 3.50% | 0.31% | 4.13% | 0.14% |

| LMT | BUY | 381 | 3.50% | 0.26% | 4.42% | 0.15% |

| LO | BUY | 284 | 3.50% | 0.19% | 4.90% | 0.17% |

| LRCX | SELL | 990 | -3.50% | -0.09% | 0.00% | 0.00% |

| LSI | SELL | 5216 | -3.50% | 0.03% | 0.00% | 0.00% |

| LUV | SELL | 2103 | -1.97% | -0.16% | 0.33% | -0.01% |

| MCD | BUY | 402 | 3.50% | 0.28% | 3.26% | 0.11% |

| MCHP | BUY | 1167 | 3.50% | 0.15% | 4.77% | 0.17% |

| MNST | SELL | 402 | -1.85% | -0.02% | 0.00% | 0.00% |

| MO | BUY | 1045 | 3.50% | 0.20% | 5.08% | 0.18% |

| MU | SELL | 6162 | -3.50% | -0.07% | 0.00% | 0.00% |

| MUR | BUY | 599 | 3.50% | 0.35% | 6.39% | 0.22% |

| MYL | SELL | 705 | -1.91% | -0.12% | 0.00% | 0.00% |

| NBR | SELL | 2496 | -3.50% | -0.22% | 0.00% | 0.00% |

| NOC | BUY | 535 | 3.50% | 0.30% | 3.31% | 0.12% |

| NU | BUY | 928 | 3.50% | 0.35% | 3.31% | 0.12% |

| NUE | BUY | 851 | 3.50% | 0.30% | 3.59% | 0.13% |

| NYX | BUY | 1530 | 3.50% | 0.30% | 5.28% | 0.18% |

| OI | SELL | 1769 | -3.50% | -0.22% | 0.00% | 0.00% |

| PAYX | BUY | 1079 | 3.50% | 0.28% | 4.01% | 0.14% |

| PBCT | BUY | 2941 | 3.50% | 0.32% | 5.46% | 0.19% |

| PBI | BUY | 3133 | 3.50% | 0.24% | 13.43% | 0.47% |

| PCAR | BUY | 126 | 0.54% | 0.04% | 3.48% | 0.02% |

| PCG | BUY | 871 | 3.50% | 0.35% | 4.54% | 0.16% |

| PCL | BUY | 833 | 3.50% | 0.30% | 4.02% | 0.14% |

| PCLN | SELL | 21 | -1.35% | -0.05% | 0.00% | 0.00% |

| PCP | SELL | 195 | -3.50% | -0.27% | 0.07% | 0.00% |

| PEG | BUY | 1197 | 3.50% | 0.36% | 4.79% | 0.17% |

| PEP | BUY | 89 | 0.62% | 0.04% | 3.04% | 0.02% |

| PFE | BUY | 1427 | 3.50% | 0.28% | 3.61% | 0.13% |

| PHM | SELL | 2055 | -3.50% | -0.22% | 0.00% | 0.00% |

| PLD | BUY | 383 | 1.31% | 0.09% | 3.30% | 0.04% |

| PM | BUY | 387 | 3.50% | 0.19% | 3.56% | 0.12% |

| PNW | BUY | 710 | 3.50% | 0.35% | 4.28% | 0.15% |

| POM | BUY | 1832 | 3.50% | 0.37% | 5.66% | 0.20% |

| PPL | BUY | 1246 | 3.50% | 0.35% | 5.07% | 0.18% |

| PXD | SELL | 324 | -3.50% | -0.18% | 0.08% | 0.00% |

| RAI | BUY | 812 | 3.50% | 0.22% | 5.40% | 0.19% |

| RDC | SELL | 451 | -1.49% | -0.09% | 0.00% | 0.00% |

| RHT | SELL | 267 | -1.33% | 0.00% | 0.00% | 0.00% |

| RRD | BUY | 3673 | 3.50% | 0.38% | 10.91% | 0.38% |

| SCG | BUY | 776 | 3.50% | 0.35% | 4.35% | 0.15% |

| SE | BUY | 1246 | 3.50% | 0.35% | 4.11% | 0.14% |

| SNDK | SELL | 174 | -0.70% | -0.04% | 0.00% | 0.00% |

| SO | BUY | 833 | 3.50% | 0.35% | 4.60% | 0.16% |

| SPLS | BUY | 2888 | 3.44% | 0.24% | 3.64% | 0.13% |

| SRCL | SELL | 380 | -3.50% | -0.25% | 0.00% | 0.00% |

| STX | BUY | 1218 | 3.33% | 0.12% | 4.26% | 0.14% |

| STZ | SELL | 30 | -0.10% | -0.01% | 0.00% | 0.00% |

| SWY | BUY | 2064 | 3.50% | 0.28% | 3.89% | 0.14% |

| SYY | BUY | 1129 | 3.50% | 0.29% | 3.54% | 0.12% |

| T | BUY | 1019 | 3.50% | 0.28% | 5.20% | 0.18% |

| TE | BUY | 2159 | 3.50% | 0.37% | 5.40% | 0.19% |

| TEG | BUY | 665 | 3.50% | 0.36% | 5.17% | 0.18% |

| TER | SELL | 2197 | -3.50% | -0.05% | 0.00% | 0.00% |

| TSO | SELL | 299 | -1.25% | -0.07% | 0.29% | 0.00% |

| TYC | SELL | 1265 | -3.50% | -0.21% | 0.00% | 0.00% |

| URBN | SELL | 444 | -1.68% | -0.09% | 0.00% | 0.00% |

| VAR | SELL | 79 | -0.55% | -0.04% | 0.00% | 0.00% |

| VMC | SELL | 432 | -2.13% | -0.15% | 0.08% | 0.00% |

| VNO | BUY | 1375 | 3.50% | 0.26% | 3.69% | 0.13% |

| VTR | BUY | 538 | 3.50% | 0.30% | 3.79% | 0.13% |

| VZ | BUY | 800 | 3.50% | 0.32% | 4.67% | 0.16% |

| WAT | SELL | 418 | -3.50% | -0.06% | 0.00% | 0.00% |

| WIN | BUY | 4207 | 3.50% | 0.32% | 12.02% | 0.42% |

| WM | BUY | 1082 | 3.50% | 0.27% | 4.38% | 0.15% |

| WMB | BUY | 1047 | 3.50% | 0.26% | 3.89% | 0.14% |

| WPI | SELL | 407 | -3.50% | -0.22% | 0.00% | 0.00% |

| WPX | SELL | 2116 | -3.50% | -0.24% | 0.00% | 0.00% |

| WYNN | SELL | 82 | -0.90% | -0.06% | 0.00% | 0.00% |

| XEL | BUY | 1345 | 3.50% | 0.36% | 4.06% | 0.14% |

| XLNX | BUY | 1024 | 3.50% | 0.12% | 2.52% | 0.09% |

| TOTAL: | 100.00% | 16.61% | 14.32% |

RSS Feed

RSS Feed