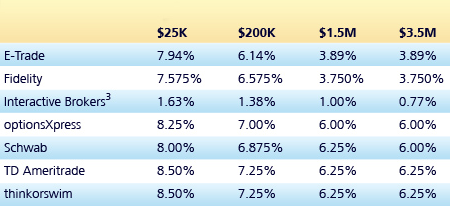

| To illustrate, let's consider the following example: say we have a investment strategy designed to produce average annualized returns of 5%. While 5% may sound meager to some investors, imagine that our strategy is a highly risk controlled one that hedges out most of the risk of overall market fluctuations (this could be a long/short portfolio for example). Therefore, leveraging the strategy up to 4 to 1 is both feasible and prudent. So, without margin (i.e. using leverage) the portfolio produces 5% annualized returns, but at a leverage ratio of 4 to 1, the porftfolio produces returns of 20%. Sounds great, no? |

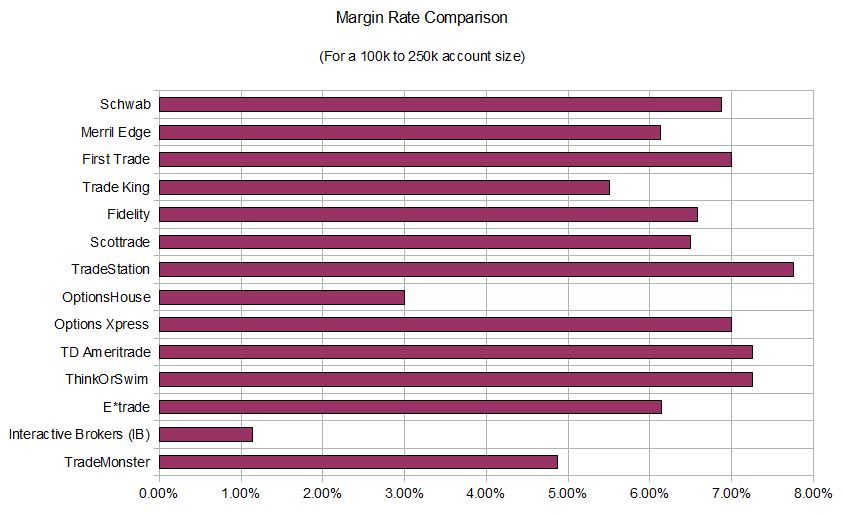

Now this is where it becomes interesting. The most indelible shift during the past 15 years in the brokerage industry has been the emergence of discount brokers, with their constant drive towards lower costs. Generally speaking, the effect this has had on commission structures has been to drive the entire industry towards similar commissions, as well as greater transparency on commission charges. While different discount brokers have different commission schedules, they are all within a competitive range.

What's the lesson here? Choose your broker wisely. The margin rate can be just as important (if not more important) than commission rates, execution, technology, or service.

RSS Feed

RSS Feed