So, I've created a new page on The Margin Investor site with an updated comparison of broker margin rates.

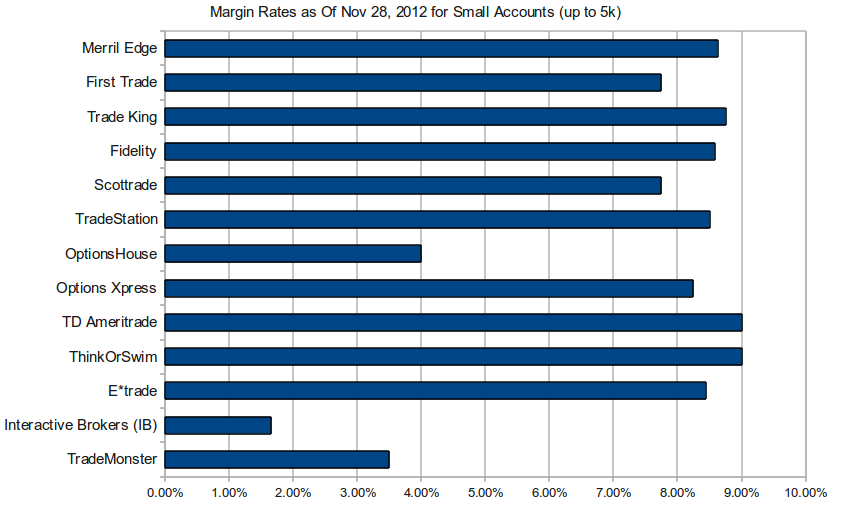

The chart below illustrates margin rates for a small brokerage account. It continues to surprise me just how how much variability there is between different brokers.

See here for the full list.

RSS Feed

RSS Feed