This all has to be put in context of course. In the grand scheme of things Portfolio Margin is still relatively new and there is plenty of time for brokers to compete for business. One thing is clear though, E*Trade is once again behind the pack.

|

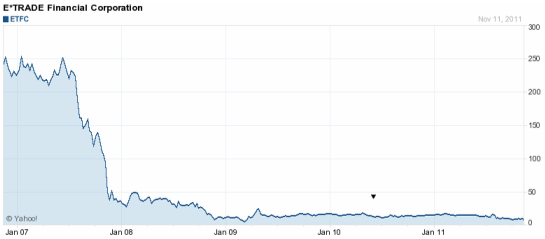

It's shocking, albeit not totally surprising that E*Trade - the once formidable on-line discount brokerage pioneer - has taken such an incredibly long time to get into the Portfolio Margin game. Their September 2011 announcement that they will now be offering Portfolio Margin Accounts comes well over three years after the SEC's approval of Portfolio Margin. Considering that brokers such as Interactive Brokers have had Portfolio Margin offerings available for several years now, it's no wonder that E*Trade's stock price has had such an unpleasant run in recent years. Now, I'm not here to bash their stock, but the lack of attention to such an attractive potential client base (under FINRA rules, portfolio margin accounts must have at least 100k in net equity value) begs the question: What is E*Trade's management focusing on?

This all has to be put in context of course. In the grand scheme of things Portfolio Margin is still relatively new and there is plenty of time for brokers to compete for business. One thing is clear though, E*Trade is once again behind the pack.

1 Comment

1/6/2012 04:28:01 pm

That is so true Jason As an author and business man, I like how you said “It's shocking, albeit not totally surprising that E*Trade - the once formidable on-line discount brokerage pioneer - has taken such an incredibly long time to get into the Portfolio Margin game “. I hope more people discover your blog because you really know what you're talking about. Can't wait to read more from you!

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorJason Apolee is a contributing editor to The Margin Investor where he focuses on news commentary and evaluating broker offerings. Archives

November 2013

Categories

All

|

RSS Feed

RSS Feed