What trader doesn't love CNBC, right?

| That said, there was a point in time where my appreciation for this news commentary changed dramatically. I remember quite distinctly the moment: it was the height of the 2009 financial crisis and my portfolio was experiencing extreme volatility. The market was up on that particular day, which was a relief for everyone as we had just experienced several large down days. I tuned to CNBC to see which bank had just staved off bankruptcy. The talking heads had a very reasonable, well thought out explanation for the precipitous market upswing. The explanation evaluated the incoming news information and built a compelling case based on fact and opinion. Satisfied with the explanation, I carried on with my day. |

| "The same narrative, the same compelling arguments, the same supporting data, but this time used to sustain the exact opposite hypothesis - that the market was surely destined to be headed into negative territory." |

The Lesson - Get the unfiltered view of the News

| "I did what seemed logical to a programmer like myself, I decided to build something.The next few weeks were spent coding software that would absorb news information from across the web and perform semantic analysis to garner meaning from the jumble of words. " |

Quantifying News Information

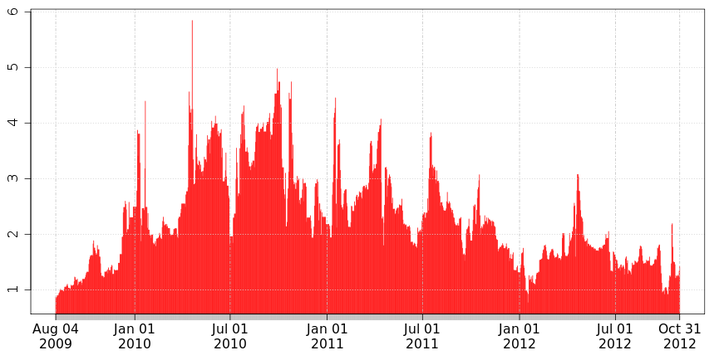

One of the metrics tracked by the program is news related to earnings. Figure 1 show the ratio of "good earnings news" to "bad earnings news", computed by classifying earnings news as either "good" or "bad" and then computing the ratio of the two. A simple example of this classification method is as follows: if the news story was about a company beating its earnings guidance then the article would be classified as "good earnings". In contrast, an earnings miss would result in a "bad earnings" classification.

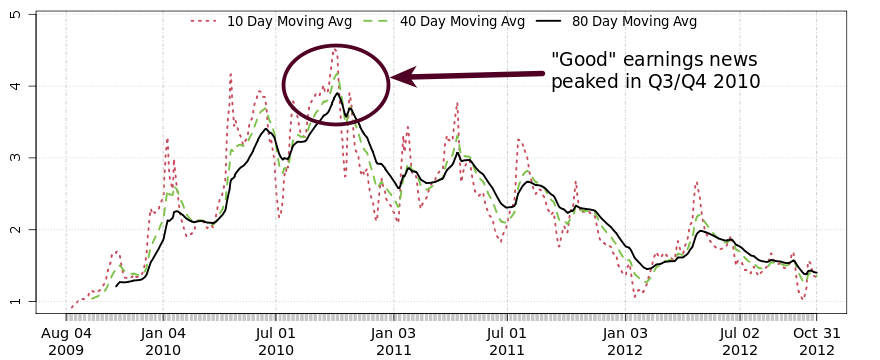

This "Good vs. Bad" earnings metric can be viewed as a guide to what type of earnings information dominates the news flow. The day-to-day metric shown in Figure 1 is quite volatile and so the moving averages show in Figure 2 provide for easier interpretation.

Well, the chart tells us that positive earnings news peaked in Q3/Q4 2010 and has been declining ever since. In fact, we're close to a three year low in S&P 500 earnings as far as the news chatter is concerned.

RSS Feed

RSS Feed