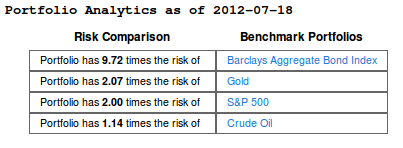

We concluded the previous post by warning about the risks involved with this type of highly leveraged fixed income ETF position. In today's post, we look at the risk profile of this strategy from a scientific standpoint. The tables below are taken from our risk system which evaluates portfolio risk using a multi-factor risk model.

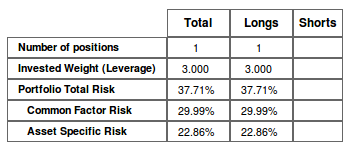

| Table 2 shows the Portfolio Total Risk and breaks it down into Common Factor Risk and Asset Specific Risk. Common factors are forces that influence a large number of stocks (think of things like yield curve movements and changes in credit spreads). Asset specific forces emanate from risk tied only to this particular ETF (e.g. characteristics of the specific bonds in the ETF's portfolio). |

- The 3 times leveraged HYG portfolio gives you a net dividend yield of over 17%, but comes with the risk of a 2 times leveraged SPY portfolio.

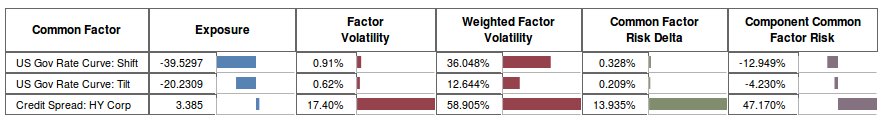

- By far and away the biggest source of risk is High Yield Credit Spreads. Therefore, it's imperative that you believe the economic picture is improving. A blow out of credit spreads could slam this portfolio hard.

- Our analysis points to ways to hedge out a big chunk of the credit spread risk, while keeping most of the dividend yield. We will explore this in a future article.

RSS Feed

RSS Feed